Estimated Reading Time [est_time]

A week or so ago I found myself without broadband and quickly ran out of mobile data. Only recently have I fully embraced mobile banking, and if asked a couple of weeks ago which app I thought I would miss the most, I would probably say Instagram, possibly Netflix. I was surprised to find it was my Nationwide banking app and Yolt, an app which provides a very easy way to manage your money from different bank accounts in one place.

I’m going to look at how the use of mobile is impacting the Financial Services sector and their digital strategy.

Finance on the go

More and more people are accessing their bank accounts via a mobile device as well as carrying out research and search enquiries. It’s essential that Banks and Credit Unions keep up to date with this trend and update their digital strategy to reflect this.

Mobile Finance apps have become more and more popular, not only can you check your balance, pay bills and make transfers – it’s amazing how simple it is to make a payment these days compared to traditional banking days. I can’t actually remember the last time I deposited a personal cheque.

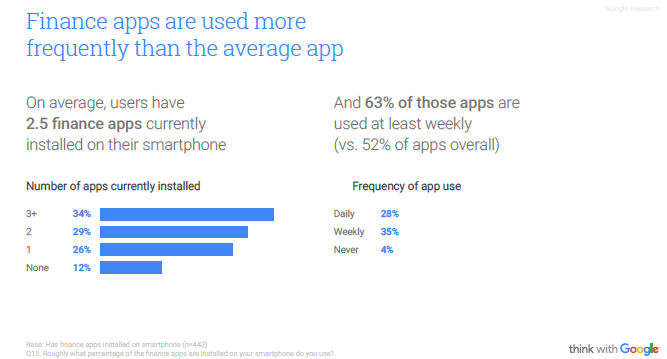

Looking at a survey carried out by Think with Google and Ipsos, on average, out of the people that responded, users had two finance apps on their mobiles and 63% of them said they used them at least weekly (compared to 52% of apps overall).

By providing easy access to common banking features, along with useful notifications for deposits, transactions and balance alerts, banking apps can certainly make our lives easier and as I’ve found out only recently, are quickly becoming indispensable.

So, what’s the main reason for downloading a finance app?

According to the same survey, for most finance app users (54%) they responded by saying it was because the app was published by their primary bank which was their main reason for downloading it. This tells us that users are loyal when it comes to financing, giving banks a great opportunity to leverage customer loyalty and drive the growth of their app organically.

How long is this likely to last?

As mentioned at the beginning I use an app called Yolt which allows you to download your banking history and account information from different accounts and store the information in one place. There are a couple of other apps offering this, OnTrees and Money Dashboard.

However, HSBC is ahead of the game when it comes to financing apps, they launched their banking app in 2018 which allows customers who give permission, to manage multiple accounts via one app. This coincided with the rollout of ‘Open Banking’ in the UK in January 2018 and could transform the way users move and use money.

What is Open Banking and why is it being introduced?

Open Banking is forcing the UK’s biggest banks to release their data in a secure, standardised format so that it can be easily shared between authorised organisations online.

This all came about following a report published in 2016 by The Competition and Markets Authority (CMA) which discovered that the older and larger banks did not have to compete for customers business and smaller, newer banks were finding it difficult to grow and access the market.

It’s probably worth mentioning that some banks are saying you could be liable for fraud if you share any login information with anyone including apps, so worth checking beforehand.

What does the future hold for mobile banking apps?

According to Marianne Lake of JP Morgan Chase, 57% of millennials will even switch banks to get a better mobile experience.

Due to the highly competitive Fintech market and the role that the mobile experience is playing in this, it’s essential that banks and credit unions are creating new and unique features to gain an edge in this space.

A recent article by The Balance explores some up and coming features of the new age banking app which look to include; card-less ATM features as well as AI customer service. As machine learning becomes stronger, these apps will be expected to make the leap to advising customers too.

Technology is constantly evolving and as more and more features are developed this will be reflected in the area of online banking apps, and digital marketers are going to have to keep abreast of these changes to ensure the changes are reflected in their strategy.

Watch this space… it’s going to be an exciting year for the Financial Services industry.